Why Victoria?

Market Outlook: British Columbia

Economy:

- The provincial population is expanding as a result of increased net international migration and the first net inflow of individuals from other provinces in a number of years.

-

In light of recent financial market volatility and declining oil prices, the outlook for the BC economy is decidedly positive.

In light of recent financial market volatility and declining oil prices, the outlook for the BC economy is decidedly positive. - Even though Canada’s economy is being besieged by plummeting global oil prices, the outlook for B.C. in 2015 remains positive and stable. Unlike other provinces in Canada (Alberta, Saskatchewan), B.C. does not rely on oil production to drive its economy. In fact, B.C.’s oil production is only a small fraction of its resource sector, which means that the recent drop in oil prices will not have a significant effect on the province’s economy.

- In BC’s manufacturing sector, where recent gains were limited to a recovering wood products industry, a diverse range of industries from pulp and paper to machinery and equipment manufacturing have registered impressive growth

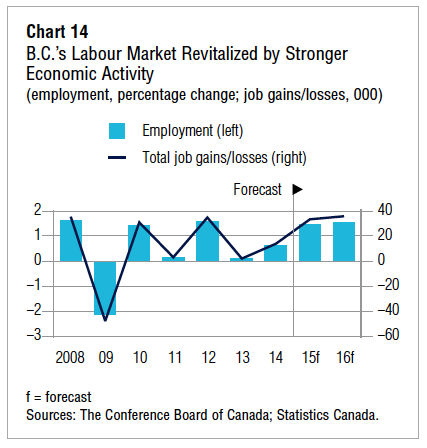

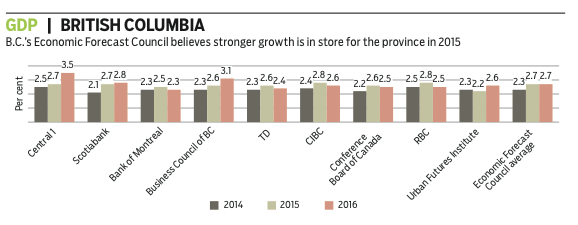

- BC’s economy is expected to grow by 2.7%, according to the Economic Forecast Council, a private-sector group comprised of 14 economists who provide a benchmark forecast to the B.C. government.

- Also, according to the forecast council, consumer spending is expected to increase, in part because British Columbians will have more money in their pocket from lower gasoline prices. Cross-border shopping could also be dampened by the slumping loonie.

- B.C.’s tourism sector continues to experience strong growth. More Americans are expected to visit B.C. in 2015 given the declining value of the Canadian dollar, a trend that should encourage more British Columbians to holiday at home. Tourism should also benefit from lower gas prices.

- While the risk of slowing global demand and the ever-present, yet never seeming to arrive, threat of higher interest rates could dampen growth next year, overall the forecasters predict that 2015 to be a strong year for the BC economy.

Housing:

- Strengthening and broad-based consumer demand is pushing BC home sales higher.

- Multiple Listing Service® (MLS®) residential sales in British Columbia are expected to rise 15.1 per cent to 83,950 units this year, and are forecast to remain essentially unchanged in 2015, albeit up a further 1.2 per cent to 84,900 units.

Market Outlook: Victoria

Economy:

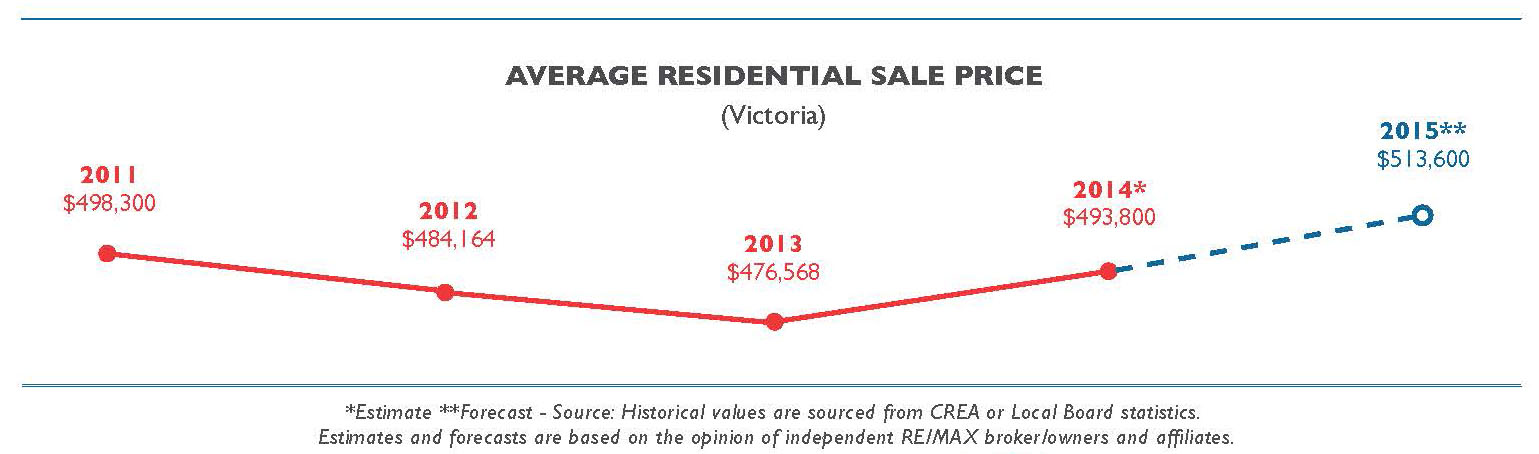

- With its well established tourism industry and thriving technology sector, the economic outlook for Victoria is healthy. The region is expecting a four per cent increase in the average residential sale price as well as a 10 to 12 per cent increase in unit sales.

- The Victoria area economy is expected to grow at a pace in line with the province, with fundamentals such as employment and population growth supporting a stable housing market. Employment is forecast to grow 0.8 per cent in 2015.

- A variety of amenities, a mild climate, educational and employment opportunities are expected to draw a steady stream of people from other parts of BC and Canada, adding to the region’s population.

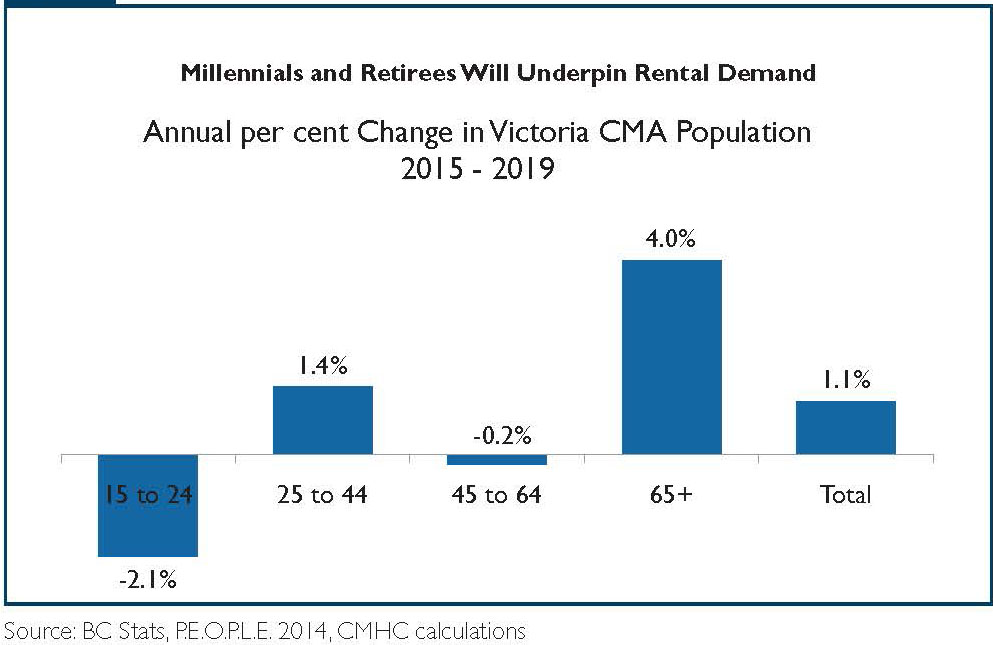

- Population growth is forecast to add an average of approximately 3,000 people to the Victoria region each year until 2018. Millenials and retirees are the population groups projected to grow at the fastest pace during the next five years, many of which will choose rental housing.

According to the chief economist for BMO, Canada's economic balance of power is forecast to shift this year from Alberta's Oilsands to British Columbia's coast.

Housing:

- Considered to be one of Canada’s most desirable cities to live in, Victoria’s real estate market remained strong throughout the year, and will continue to be strong through 2015.

- Growth in housing demand has been consistently strong throughout 2014. While record low mortgage interest rates continue to underpin housing affordability, consumers are demonstrating increased confidence through broad-based spending activity.

- More robust economic conditions are expected to further boost employment levels through 2015 and further fuel housing demand.

- Total active residential listings in Victoria are at their lowest level since 2010. This combined with rising consumer demand has put market conditions on the cusp of a seller’s market.

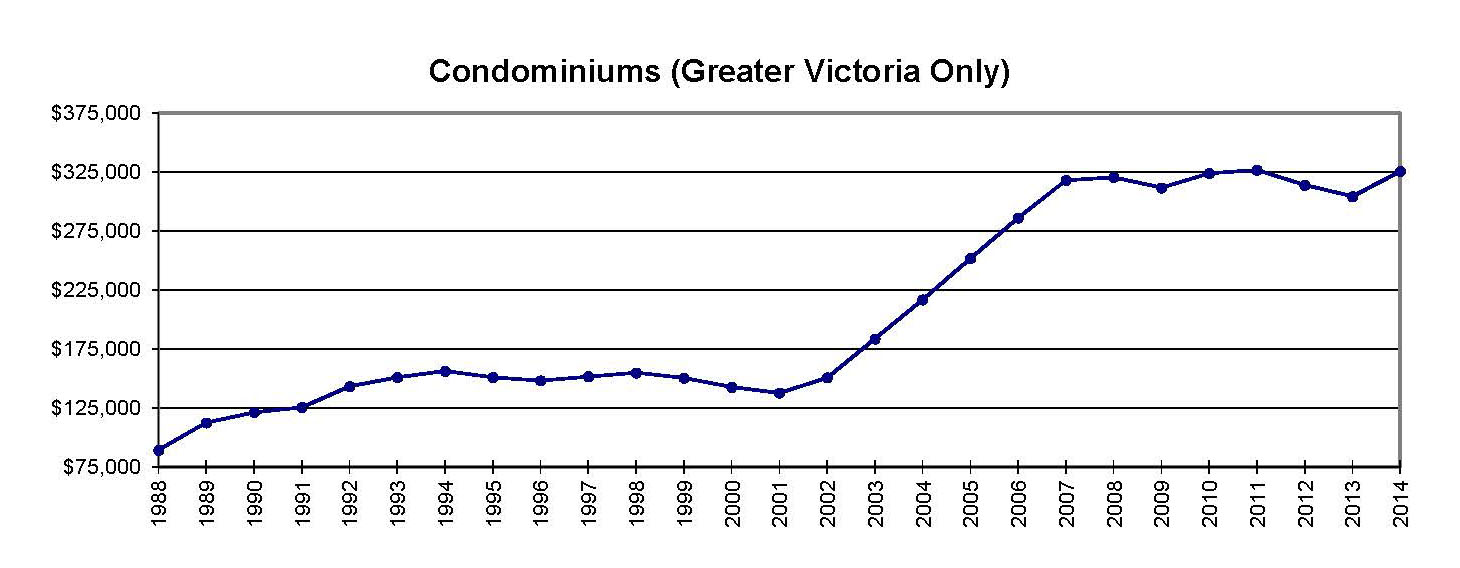

- Demand from first-time buyers should play a significant role in Victoria’s real estate market in 2015. These buyers often enter the market by purchasing a condominium

- Interest rates are anticipated to be the predominant factor in the 2015 housing market, coupled with the lack of available affordable housing.

- Consistent with the view of Canadian economic forecasters, CMHC expects interest rates to register gradual and modest increases by the latter part of the 2015 forecast horizon. This will lead to increases in mortgage rates. Despite this, mortgage rates will remain low and will continue to support housing market activity in 2015.

- Overall, a rate increase is not anticipated to have a dramatic effect on the real estate market, as it would likely be minor and rates would continue to be low.

- The Bank of Canada had hinted at a rate increase in late 2015, and some experts had speculated that the increase could have come as early as May. However, with oil prices at less than $50 per barrel, the Bank of Canada cut its key overnight lending rate to 0.75.

- The cut would result in lower interest rates for variable rate mortgages, lines of credit and other loans that float with prime rates, but only if banks lower their prime rates. Regardless, rates should remain low throughout 2015.

Rentals:

- Demand for rental accommodation is expected to keep pace with an increasing supply, leading to relatively stable apartment vacancy rates this year and next. Rent increases are projected to remain modest, with one-bedroom rents rising faster than larger units.

- The average vacancy rate in the city is forecast to average 1.6%, slightly down from 2014’s 3.0%

- Many young Millennials will live in rental accommodation through their postsecondary and early working years before entering home ownership.

- With several large post-secondary institutions, Victoria’s education sector provides a solid employment base as well as demand for rental housing from the large student population.

- Victoria’s relatively high home prices, among the highest in the country, will support this trend. Likewise, retirees, particularly single people in their 70s and 80s, will remain in rental housing, maintaining their independence.

- The Victoria rental market is a solid investment. The rental vacancy rate is 1.6 per cent and it got as low as sub-1 per cent five years ago - but considered healthy for investors.

- A two-bedroom apartment rents for $1,059 on average, according to Canada Mortgage and Housing Corp., slightly higher than the national average of $900. Survey results also show Victoria rent increases were held under 1 per cent for two-bedroom units ¬during the last year, even though landlords legally could have charged more than 4 per cent.

- This very healthy market stability has lured REITs, who have been quietly buying up Victoria apartment buildings in the past four years.